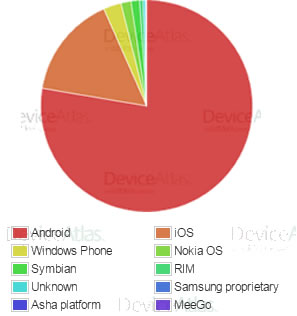

#MOBILE PHONE OS MARKET SHARE 2014 ANDROID#

The winners were the Android sellers, but since their gains were rather evenly divided there’s no one big winner. Apple gained a bit, but its growth is nowhere near as huge as in 2009. I’m not sure if 2009 or 2010 is the aberration here. In 2010 RIM lost the share it gained in 2009. The volatility was larger in 2009 (13%) than in 2010 (10%), because the first year saw the removal of many small vendors, their share mostly ending up with Apple and RIM. It gives a measure for how much the market is changing. that the winners won or the losers lost). My favourite metric is the volatility, the total amount of market share that changed hands (i.e. So how did market shares change? Yearly smartphone sales market share Vendor The point of the current smartphone game is to win market share for yourself and your platform, and this is where all vendors focus on. Still, the real point here is not absolute but relative growth. Over 2010 as a whole Apple sold a few hundred thousand units less than RIM, so it remains the third-largest smartphone vendor, even though it passed RIM in Q3. (Why? Android.) Apple performed somewhat better than average, but not outstandingly so. Relatively, Samsung performed best, and HTC did very well, too, as did most minor vendors. Nokia and RIM disappoint, even though in absolute numbers Nokia posted the strongest growth. Thus, any vendor peformance lower than 70% growth is distinctly disappointing. Yearly smartphone sales in millions Vendor Smartphones now constitute 22% of all mobile phones, up from 14%. Total mobile phone sales grew from 1,260 to 1,370 million, or 9%. In 2010 298 million smartphones were sold worldwide, up from 175 million in 2009, for a healthy 70% growth rate. Let’s start with the total sales numbers (in millions), the mother data from which all other data points are descended. These instances are indicated in the articles. I had to guesstimate a few figures myself where Tomi’s stats were incomplete. If you already know them by heart this post won’t tell you anything new.

Specifically, the following articles were my sources.

I use Tomi’s numbers because I prefer figures that take all analyses into account over the opinion of one particular company. SourceĪll figures in this and the next entry come from Tomi Ahonen, who takes the data from the four analysis houses (Gartner, IDC, Canalys and Strategy Analytics), averages them, and peforms some secret magic on them (probably weighting based on past performance and/or comparing them with the filings of the device vendors). Nokia and RIM lost heavily: they grew only a sluggish 47 and 30%, respectively. Biggest growers were the Android suppliers (Samsung and HTC especially), as well as Apple. In 2010 298 million smartphones were sold worldwide, up from 175 million in 2009, for a growth rate of 70%. This entry gives the device vendor stats for 2010, the next one will discuss OS stats. Sitemap contact Smartphone sales 2010 - vendorsĪfter having discussed mobile browser traffic share statistics for weeks, it’s time to look at the other side of the medal: smartphone sales market shares.

0 kommentar(er)

0 kommentar(er)